U.S. to target banks that help Russia war in Ukraine

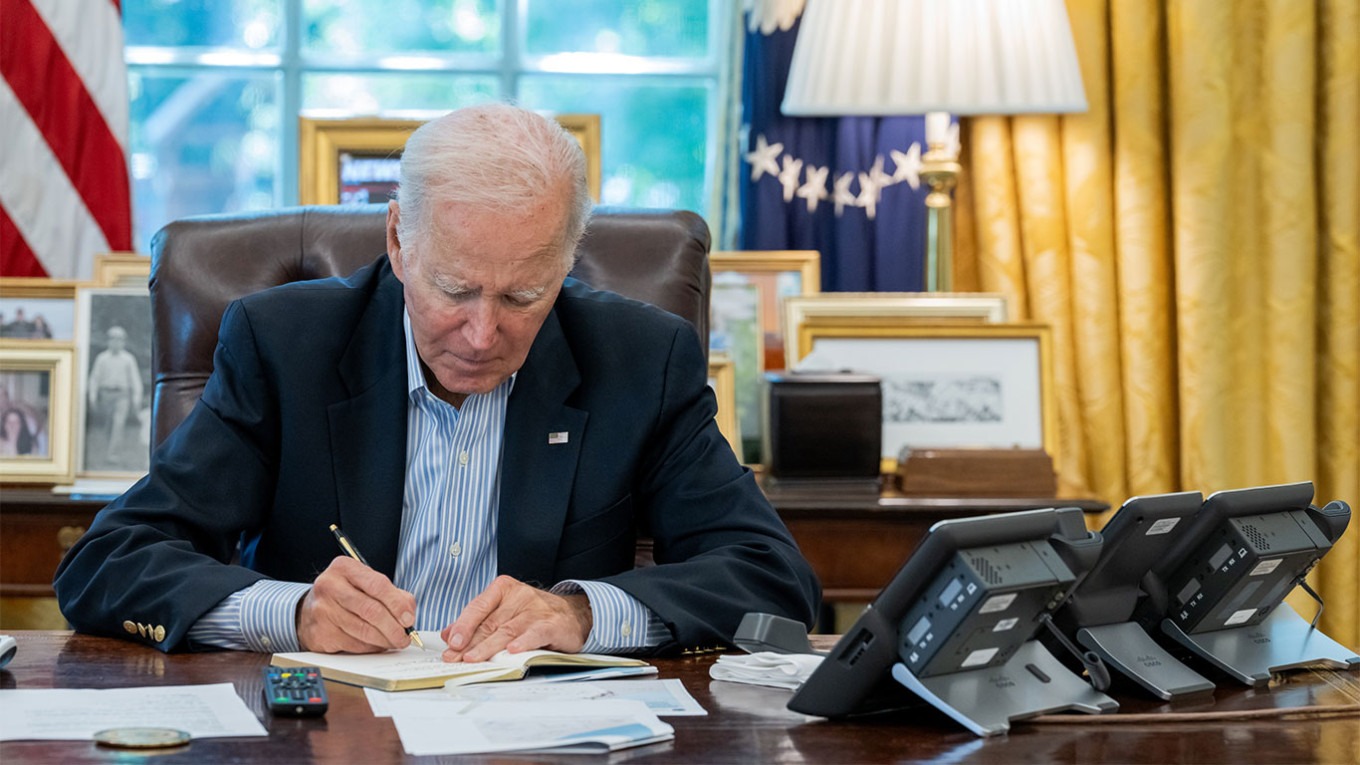

Major move to counter Russia’s war in Ukraine, the United States, under President Joe Biden’s executive order, is set to impose sanctions on foreign banks supporting Moscow’s defense industry. This utterance comes as part of a broader strategy to exert pressure on Russia, which has been urgently diversifying its economic ties yonder from the West, particularly towards China.

Jake Sullivan, Biden’s national security advisor, emphasized the significance of the move, stating, “We are sending an unmistakable message: anyone supporting Russia’s unlawful war effort is at risk of losing wangle to the US financial system.” These new sanctions, termed as secondary sanctions, are designed to remoter tighten the screws on Russia’s war machinery and its enablers.

Sullivan asserted that older measures have “significantly degraded” Russia’s military capabilities, once perceived as among the world’s most formidable. Recent months have witnessed Russia relying on imports from sanctioned North Korea and Iran, highlighting the impact of existing international pressure.

A noteworthy shift has been observed as Russia moves yonder from trading in major currencies such as dollars, euros, sterling, and yen. China’s largest banks have capitalized on this shift, extending billions of dollars in renminbi credits to Russia, marking a significant turn yonder from Western institutions.

Deputy Treasury Secretary Wally Adeyemo shed light on the strategic targeting of financial institutions. Major banks in countries like China, Turkey, and the United Arab Emirates have made efforts to stave running afoul of U.S. sanctions. However, the focus of the new measures will be on smaller institutions that might have slipped under the radar.

Adeyemo revealed Russia’s use of front companies to obscure purchases through third countries, emphasizing, “They’re going through small firms to get things like micro-electronics and machine tools and engine parts.” Despite these maneuvers, all these transactions inevitably involve the financial system, making it a key point of intervention.

Russia’s economy, while feeling the impact of international pressure, continues on a growth trajectory. The International Monetary Fund forecasts a 1.1% expansion in 2024. A key target for Western powers has been Russia’s oil exports, capped at no increasingly than $60 a barrel.

However, assessments of the impact vary. A recent study by the Kyiv School of Economics pointed out virtually non-existent compliance with the price cap due to widespread fraud. As the G7 hesitates to seize Russian government resources to support Ukraine, the United States’ focus on secondary sanctions emerges as an volitional ways of applying pressure.

Parallel deportment on December 22 involve the U.S. stepping up sanctions versus Russian diamonds and seafood. The ban on their import, plane if processed elsewhere, aligns with recent European Union measures versus Russian diamonds. Notably, the U.S. has been increasingly deploying secondary sanctions despite concerns that it might encourage other countries to move yonder from the dollar.

The Biden administration’s visualization to blacklist foreign financial institutions supporting Russia’s military industrial ramified adds a layer to Washington’s efforts to curtail Moscow’s war machine. The executive order will empower the U.S. to sanction banks involved in facilitating transactions for goods used in the battlefield, remoter complicating Russia’s procurement strategies.

As the U.S. engages with European and U.S. banks to ensure compliance with these new rules, the strategic use of secondary sanctions emerges as a targeted tool aimed at key materials essential to Russia’s weapons production. With the financial system vicarial as a potential chokepoint, the U.S. aims to disrupt Russia’s worthiness to build its arsenal, underscoring the nuanced tideway taken in the evolving dynamics of international economic warfare.

The #UnitedStates said Friday it will sanction foreign banks that support #Russia's war in #Ukraine, in a new bid to exert economic pressure on Moscow as it diversifies from the West to China.https://t.co/P83rRQ31TK

— The Hindu (@the_hindu) December 22, 2023