After RBI Policy market Cheers as Nifty Surpasses 21,000 and Sensex Hits Record High

Equity Markets Scale New Heights Without RBI Maintains Unchanged Repo Rate

In a bullish session, the 50-share benchmark alphabetize opened on a positive note, reaching 21,006.10, with the Nifty breaching the psychological milestone of 21,000. This surge was witnessed without the Reserve Bank of India’s (RBI) visualization to alimony policy rates unchanged, aligning with market expectations.

The Sensex, riding on the positive sentiment, touched an all-time intraday upper of 69,888.33. Analysts noted that the probity market positively responded to the RBI’s monetary policy decision, maintaining a steady stance to ensure inflation aligns with the target while supporting growth.

As trading progressed, 25 stocks traded in the green, while 24 stocks defied the broader market trend, trading in the negative territory. The Nifty Midcap Select alphabetize edged higher by 0.1%, with Nifty Bank up-and-coming by 0.48%, and Nifty Financial Services registering gains at 21,133.30 points.

Key Gainers and Losers in the Benchmark Nifty Index:

Major gainers included LTIMindtree (3.17%), JSW Steel (2.97%), HCL Tech (2.96%) and HDFC Bank (1.41%)

Among the laggards, Adani Ports witnessed the most significant decline, lanugo by 1.55%, followed by Bajaj Finance (down 1.37%), Adani Enterprises (down 1.23%), and Hero MotoCorp (down 1.18%).

Sensex Performance:

Among the Sensex scrips, 19 stocks advanced, and 11 stocks witnessed a decline.Market analysts highlighted the RBI’s well-turned approach, considering both growth and inflation. Gaurav Dua, Head – Capital Market Strategy at Sharekhan by BNP Paribas, commented, “We remain positive on probity markets in the near-to-medium term with real estate, banks, consumer, and engineering/capital goods as preferred sectors.”

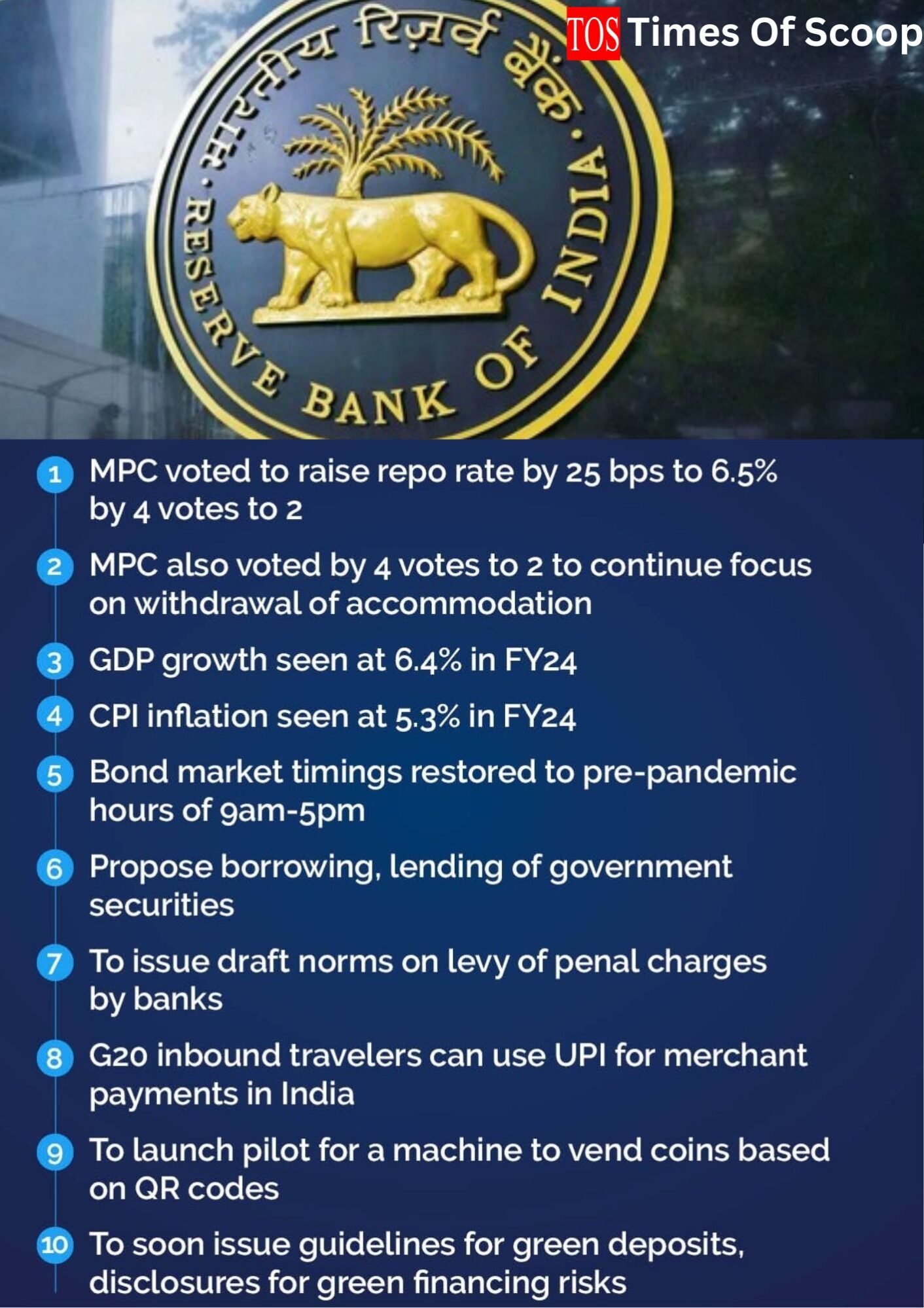

RBI’s Monetary Policy Highlights:

RBI Governor Shaktikanta Das spoken the pursuit key highlights during the printing briefing:

Repo rate remains unchanged at 6.5%, with the MPC voting unanimously in favor.

GDP growth forecast for FY24 raised to 7% from 6.5%.

Inflation projection for the fiscal year retained at 5.4%.

RBI’s focus remains urgently disinflationary.

The wastefulness sheet of the Indian financial sector remains robust.

While the RBI’s well-turned tideway was appreciated, market participants welcomed the positive growth outlook and retained inflation projections. As the probity markets hit new highs, investors maintain optimism, anticipating sustained growth in the near term.

Disclaimer: The views and investment tips expressed by experts on Timesofscoop.com are their own and not those of the website or its management. The Times of Scoop advises users to trammels with certified experts surpassing taking any investment decisions.

You are a very persuasive writer. I can see this in your article. You have a way of writing compelling information that sparks much interest.

Hi there, I found your website via Google while searching for a related topic, your website came up, it looks great. I have bookmarked it in my google bookmarks.